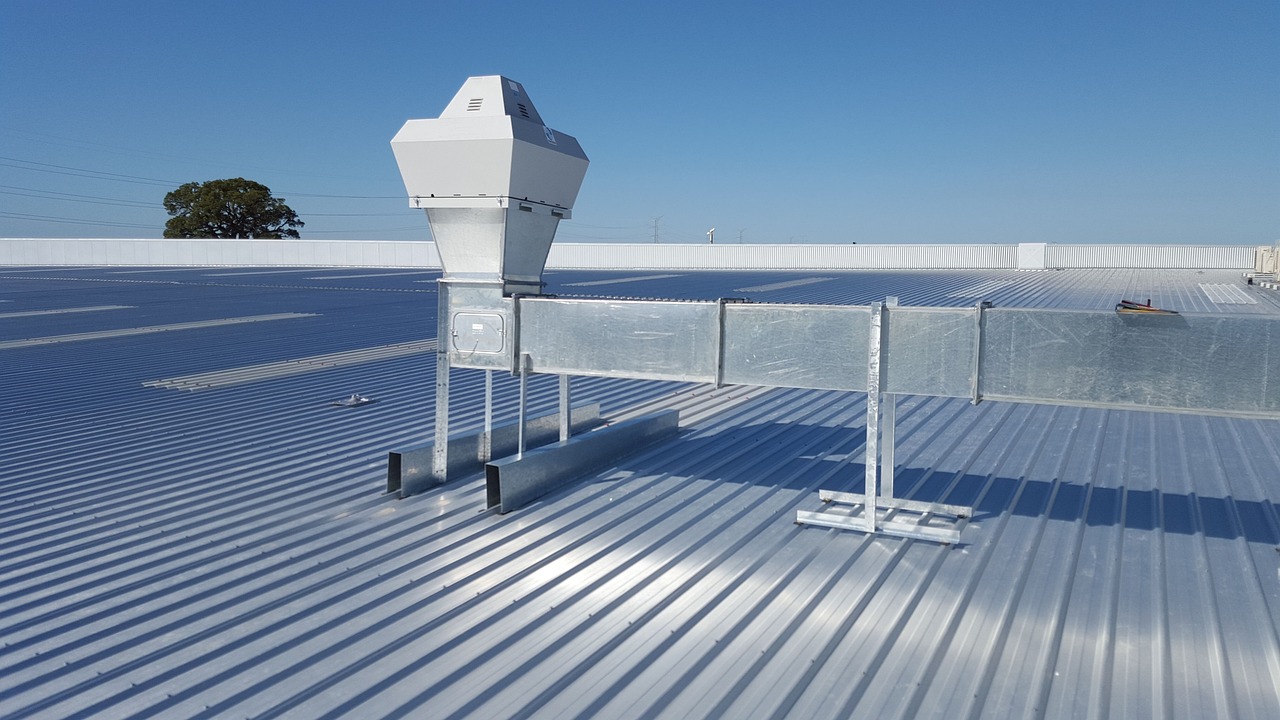

Do you potentially want to sell your HVAC business, now or in the future? The HVAC industry is a vital component of modern infrastructure, ensuring that residential, commercial, and industrial spaces maintain optimal comfort and energy efficiency. Today’s HVAC systems go far beyond traditional heating and cooling—they incorporate advanced technologies, smart controls, and eco-friendly designs that contribute significantly to energy conservation and improved indoor air quality. This evolving sector is marked by a dynamic blend of technological innovation and regulatory shifts, making it an exciting space for both operational success and strategic business transitions.

- With the increasing emphasis on sustainability and green building practices, HVAC companies are continuously adapting to new market demands. This trend is reflected in the rising adoption of energy-efficient systems and smart home integrations, which are reshaping industry standards and consumer expectations alike. An in-depth HVAC industry overview reveals that modern systems are now designed to optimize performance while minimizing environmental impact, creating a competitive market that values both innovation and compliance with stringent energy regulations.

- For many business owners, understanding these HVAC market trends is the first step toward making informed strategic decisions. Whether you’re looking to capitalize on the burgeoning demand for modern systems or considering an exit strategy, staying ahead of industry developments is essential. As market dynamics evolve, the opportunity to transition your business on your terms becomes ever more appealing. In this context, the strategic decision to sell your hvac business can be a powerful move for owners aiming to capture the full value of their hard work and investment.

Why Now is a Prime Time to Sell an HVAC Business

The current economic landscape is exceptionally favorable for owners contemplating an exit. Driven by rising energy costs, expansive infrastructure projects, and a surge in sustainable practices, the market for HVAC acquisitions is booming. Key indicators such as strong recurring revenue from service contracts, high customer retention rates, and ongoing technological advancements have all contributed to making HVAC businesses highly attractive assets.

-

- High buyer interest is evident in today’s market, with strategic investors, financial buyers, and private equity firms all actively seeking opportunities in the HVAC sector. This surge in interest is reflected in increasingly competitive bidding processes, which often lead to elevated valuations and improved deal terms. Moreover, robust HVAC market trends, such as the rapid adoption of smart systems and environmentally friendly technologies, ensure that businesses are well-positioned to capture future growth.

-

- The timing of an exit is critical. Economic stability and favorable regulatory environments in many regions have resulted in record-high valuations for well-run HVAC companies. For owners carefully considering their next steps, this environment provides a unique window of opportunity to maximize returns. Those who decide to sell your hvac business can benefit from the competitive marketplace, ensuring that both price and transaction terms reflect the true value of their business assets.

-

- In addition, expert analyses point out that strategic market conditions rarely align as favorably as they do now. This convergence of favorable factors makes it an ideal time for business owners to reassess their long-term goals and evaluate the benefits of transitioning out of day-to-day operations. With a competitive landscape attracting multiple buyers, sellers are well-advised to leverage these conditions to secure the best possible deal.

The Wave of HVAC Industry Consolidation

A prominent trend reshaping the HVAC landscape is industry consolidation. Increasingly, larger companies and private equity firms are acquiring smaller, independent HVAC operators as part of a strategic drive to create expansive, integrated service networks. This consolidation is not only redefining market boundaries but is also significantly influencing valuation trends and buyer expectations.

- One of the primary benefits of consolidation is the realization of economies of scale. By integrating smaller entities into a larger operational framework, buyers can streamline processes, reduce overhead costs, and offer more competitive pricing. For sellers, this translates into an environment where a well-positioned business can command a premium if it aligns with the strategic objectives of a consolidator. As companies look to expand their market footprint, having a solid operational base becomes a key selling point.

- Moreover, the consolidation trend underscores the importance of aligning your business for a strategic exit. Buyers are increasingly interested in companies that offer not just strong current performance, but also potential for seamless integration into a larger network. Detailed analysis of HVAC consolidation trends reveals that businesses with modern systems, robust customer contracts, and innovative service models are particularly attractive targets. These factors, coupled with strategic market positioning, create an ideal scenario for sellers aiming to optimize their exit.

- By closely monitoring industry developments and positioning your business appropriately, you can take advantage of these consolidation trends. Ultimately, the goal is to be in the best possible position when entering a competitive bidding environment, ensuring that the transition yields maximum benefits for both price and favorable deal structure.

How Private Equity is Powering Growth

Private equity has become a driving force within the HVAC sector, significantly impacting how transactions are structured and valued. With their strong focus on operational efficiency and growth, private equity firms are attracted to HVAC businesses that demonstrate robust cash flow, recurring revenues, and strong market positioning. Their involvement often results in an injection of capital that not only modernizes operations but also spurs rapid expansion.

- Beyond mere financial support, private equity brings a wealth of industry expertise and strategic guidance. These firms are adept at identifying growth opportunities and implementing operational improvements that can transform a business’s performance. Whether it’s upgrading outdated systems, optimizing service delivery, or expanding into new markets, the expertise provided by PE investors can make a substantial difference in a company’s competitive standing.

- The competitive environment fostered by private equity participation has another significant benefit: it often drives up the overall valuation of HVAC businesses. With multiple firms actively seeking investment opportunities in the sector, sellers can expect a more competitive bidding process that results in better pricing and more favorable transaction terms. This competitive pressure is especially important in a market where the complexities of an HVAC sale process can sometimes diminish the ultimate value captured by the seller.

- For those weighing their options, this is a key moment to consider strategic alternatives. Owners who choose to sell your hvac business in a landscape rich with private equity interest stand to benefit immensely. The infusion of expert capital combined with a competitive marketplace creates an environment where both immediate returns and long-term strategic benefits are maximized.

Sell Your HVAC Business: Why This Is a Complex Sale

While market trends and consolidation dynamics may paint an attractive picture, the process of selling an HVAC business remains inherently complex. Business owners must navigate a multifaceted process that includes detailed due diligence, stringent regulatory compliance, and sophisticated negotiations—all of which require a deep understanding of the industry’s intricacies.

-

- The due diligence phase is often the most challenging part of the transaction. Prospective buyers will meticulously review financial records, operational data, customer contracts, equipment inventories, and regulatory compliance documentation. Any gaps in documentation or inconsistencies in the data can lead to prolonged negotiations or even jeopardize the transaction. Ensuring that every aspect of your business is meticulously documented and presented is critical to building buyer confidence and securing a successful sale.

-

- Regulatory and licensing requirements further complicate the process. The HVAC industry is subject to a variety of environmental, safety, and operational regulations that must be strictly adhered to. Maintaining compliance with these standards is essential not only for the smooth operation of your business but also for instilling confidence in potential buyers. Failure to meet these regulatory benchmarks can result in significant delays or additional costs during the transition.

-

- Negotiations themselves present another layer of complexity. Relying on a single interested party can severely limit your negotiation leverage, potentially leading to a deal that does not fully capture the true value of your business. A competitive bidding environment, where multiple buyers are engaged, can help drive up the sale price and secure more favorable terms such as earnouts, rollover equity, and structured transition agreements.

-

- The process of selling is not just a financial or operational decision—it is also an emotional journey. Many HVAC business owners have dedicated years to building their companies, and the decision to exit can be both challenging and deeply personal. The emotional aspects of letting go, coupled with the operational pressures of preparing for a sale, can make the process overwhelming without the right support.

-

- For owners seriously considering their exit strategy, it is essential to work with seasoned professionals who specialize in the complex HVAC sale process. Their expertise in navigating due diligence, managing regulatory compliance, and facilitating negotiations is invaluable in ensuring that you achieve a successful outcome. When you are ready to sell your hvac business, partnering with experts can transform an otherwise daunting process into a seamless transition that maximizes both financial returns and long-term benefits.

The Danger of Relying on a Single Buyer

Once you’ve figured out how to sell your business with the help of a qualified business broker and found a few people or companies that might be interested, it’s time to start reviewing offers. The process starts when a company or individual submits an Indication of Interest (IOI) or a Letter of Intent (LOI). IOIs are generally reserved for competitive deals where brokers must limit the number of participants, while LOIs are necessary to choose a winner for a deal.

-

- When only one party is involved, the buyer has the power to dictate not only the sale price but also the overall transaction structure. This phenomenon, often referred to as single-buyer risk, can lead to an imbalance in power during negotiations. In such scenarios, the buyer may impose conditions that could include lengthy due diligence periods, restrictive earnout agreements, or even significant contingencies that compromise the overall value of the deal.

-

- A competitive bidding process is crucial in today’s market. By inviting multiple offers, you create an environment where buyers must compete—not only on price but also on terms such as non-compete clauses, seller financing, and transition support. This competitive approach can significantly enhance the attractiveness of your proposal and result in a more favorable outcome. Moreover, understanding the current HVAC market trends can help you set realistic expectations and ensure that the final agreement aligns with the true value of your business.

-

- The key takeaway here is that relying solely on one offer is akin to putting all your eggs in one basket. Instead, exploring a range of options ensures that you capture the full spectrum of value available. For owners looking to strategically exit, it is essential to develop a comprehensive marketing strategy that reaches a broad pool of qualified buyers. This approach minimizes risk and maximizes the likelihood of achieving a transaction that reflects the strength and potential of your HVAC business.

Why You Need a Well-Qualified Business Broker

Navigating the complexities of an HVAC sale is rarely a straightforward process. The intricate steps involved—from detailed due diligence and regulatory compliance to negotiating the final deal—demand a high level of expertise and industry-specific knowledge. This is why partnering with a well-qualified business broker is indispensable when you decide to sell your hvac business.

- Experienced brokers bring a wealth of specialized knowledge to the table. They understand the nuances of HVAC valuations, including the importance of recurring revenue, long-term service contracts, and equipment assessments. Their insights into HVAC consolidation trends and private equity interests enable them to accurately position your business in the marketplace, ensuring that potential buyers understand its full value.

- Moreover, seasoned brokers possess a robust network of industry contacts, including strategic buyers, financial investors, and private equity firms actively seeking opportunities in the HVAC sector. This network is vital in creating a competitive bidding environment, where multiple offers drive up both price and favorable transaction terms. A skilled broker not only identifies the right buyers but also manages the entire process, streamlining the complex HVAC sale process and mitigating potential risks.

- In addition to facilitating negotiations, brokers also handle sensitive aspects such as confidentiality, which is critical during the early stages of discussions. By maintaining strict confidentiality protocols, they ensure that the sale process does not disrupt ongoing operations or affect customer relationships. Their ability to handle intricate details—ranging from legal documentation to regulatory compliance—makes them an invaluable partner in securing a smooth and successful transition.

Introducing CGK Business Sales as the Ideal Solution

When it comes to transitioning your HVAC business, choosing the right partner can make all the difference. CGK Business Sales stands out as the ideal solution for owners who wish to achieve an optimal exit. With a proven track record of successfully managing HVAC transactions, CGK Business Sales combines deep industry expertise with a sophisticated marketing approach tailored to the specific dynamics of the HVAC market.

- CGK Business Sales has extensive experience working with businesses of all sizes—from family-owned companies to larger regional operators. Their approach is built on a foundation of transparency, industry knowledge, and strategic insight. By understanding the intricacies of HVAC market trends and the factors driving consolidation and private equity interest, they are uniquely positioned to maximize the value of your business.

- One of the hallmarks of CGK’s approach is their commitment to creating a competitive auction process. This strategy ensures that multiple qualified buyers are engaged simultaneously, generating robust offers not only on price but also on critical deal terms. Such a process is instrumental in safeguarding against the risks associated with a single-buyer scenario, ultimately resulting in a more balanced and advantageous transaction.

- For HVAC business owners who decide it’s time to transition, partnering with a reputable advisor like CGK Business Sales provides peace of mind. Their comprehensive service offering—from initial valuation and strategic planning to final negotiations and post-sale support—ensures that every aspect of the transaction is handled with the utmost professionalism and care.

The Power of an Auction Process for Your HVAC Business

A standout feature of a successful HVAC sale is the implementation of an auction process. This method leverages the competitive spirit of multiple buyers to secure not only the best price but also the most favorable terms for the seller. An effective auction process for selling HVAC business assets creates an environment where strategic bidding drives up value and ensures that every critical element of the transaction is optimized.

- The auction process is designed to maximize transparency and competition. Rather than engaging with a single interested buyer, the process involves inviting multiple qualified buyers to submit competitive bids. This not only enhances your negotiation leverage but also helps in balancing various deal components such as upfront cash, earnouts, rollover equity, and other critical terms.

- When multiple buyers are involved, they are compelled to refine their offers to remain competitive. This competitive dynamic often leads to superior outcomes, where the final deal reflects both a high sale price and a well-structured agreement. Additionally, the auction process minimizes the risk of a protracted sale process that can occur when negotiations are limited to one party. The result is a streamlined, efficient process that benefits all parties involved.

- For many HVAC business owners, the decision to embrace an auction strategy is a game changer. It provides an objective framework to evaluate offers and select the one that best meets their strategic and financial objectives. The benefits of this approach are particularly evident in markets characterized by rapid changes in HVAC market trends and dynamic buyer behavior.

- Leveraging an auction process not only secures better financial outcomes but also ensures that the transition is smooth and strategically sound. It is a testament to the value of competitive bidding in realizing the full potential of your business sale.

- However, running a proper auction is not without its challenges. Buyers often prefer to avoid bidding wars, as aggressive competition can escalate prices to levels that may deter participation. If you lack the experience and expertise to manage a sophisticated auction process, you run the risk of not only losing a single buyer but potentially alienating all potential buyers. A poorly executed auction can stifle buyer enthusiasm, leading to a situation where the anticipated competitive dynamic fails to materialize. This is why partnering with professionals who understand the nuances of an effective auction process is crucial—they ensure that the process is conducted seamlessly, maintaining buyer interest and ultimately driving the best possible outcome for your HVAC business sale.

Conclusion and Next Steps

In conclusion, the process of selling an HVAC business is multifaceted, influenced by evolving market dynamics, industry consolidation, and the growing influence of private equity. Throughout this comprehensive guide, we have explored the various facets of the HVAC industry—from understanding market trends and regulatory challenges to leveraging competitive bidding and the expertise of professional brokers.

- The journey to a successful exit begins with a clear understanding of the complexities involved. Whether it’s addressing the risks associated with a single-buyer scenario or harnessing the benefits of a well-structured auction process, every aspect of the sale requires careful planning and execution. A robust strategy that encompasses thorough due diligence, strategic positioning, and expert negotiation is essential in today’s competitive market.

- For HVAC business owners contemplating the next step in their journey, the value of expert guidance cannot be overstated. By partnering with seasoned professionals who understand the intricacies of the complex HVAC sale process, you not only mitigate risks but also enhance the overall outcome of your transaction. The insights gained from studying HVAC consolidation trends, private equity influences, and current HVAC market trends can empower you to make well-informed decisions that maximize the value of your business.

- As you consider your options and plan your transition, remember that timing and strategic planning are key. Every element—from regulatory compliance and due diligence to negotiations and buyer engagement—plays a critical role in shaping the final outcome.

- Ultimately, the decision to sell your hvac business should be approached with a focus on long-term value, ensuring that you capture the full potential of your investment while positioning yourself for future opportunities. With the right strategy and expert support, you can transform what may seem like a daunting process into a rewarding and successful transition.

Looking ahead, the next step is to schedule a consultation with industry experts, like CGK Business Sales, who can guide you through every stage of the process. Whether you are ready to engage in a competitive auction process or need assistance in preparing your business for sale, expert advisors are available to help you navigate this challenging yet promising landscape. Embrace the opportunity to maximize your returns and secure a future that aligns with your personal and professional goals.

What They’re Saying

Confidential. Contact. Conversation.

Let's get started.

The experts at CGK Business Sales are ready to talk to you about mergers & acquisitions, business valuations, or selling your HVAC business. And it’s always 100% confidential.

Our unique selling process is tailored for HVAC businesses with at least $1.5 million in revenue (up to $100 million) and $300,000 to $10,000,000 in owner’s profit.

OUR TEAM

DavidSmoot

ManagingDirector

David Smoot has 20 successful years working for Fortune 500 companies in sales and finance and owning his own small businesses. His leadership roles included sales, finance, managing multi-million dollar product launches, training new ... (click David's picture to read more)

Austin Office:

2720 Bee Caves Road

Austin, TX 78746

(512) 900-5960

San Antonio Office:

700 N Saint Mary's St

San Antonio, TX 78205

(210) 526-0094

Houston Office:

1200 Smith St

Houston, TX 77002

(713) 588-0240

Dallas Office:

325 N Saint Paul St

Dallas, TX 75201

(469) 998-1968

Phoenix Office:

40 N Central Ave

Phoenix, AZ 85004

(602) 714-7470

Colorado Springs Office:

102 S Tejon St

Colorado Springs, CO 80903

(719) 471-0115

Denver Office:

1600 Broadway

Denver, CO 80202

(303) 974-7978

Nashville Office:

424 Church St

Nashville, TN 37219

(615) 800-7118

Louisville Office:

312 S 4th St

Louisville, KY 40202

(502) 287-0332

Baltimore Office:

111 S Calvert St

Baltimore, MD 21202

(410) 777-5759

Washington DC Office:

1050 Connecticut Ave NW

Washington, DC 20036

(202) 888-6120